How to improve your credit score with one change in payment habits

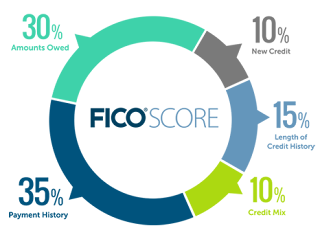

Looking at the above breakdown of a FICO score is it clear to see that if you can improve the amounts owed category it will have a big impact on your score, right? Well luckily there is an easy way to achieve this. This 30% factor of your score is something also called your credit utilization %, or how much of your current credit limit you are using. This percentage is calculated every month when your statement is generated, which is typically the point when your credit card balance will be at its highest. However, if you pay down the balance of your card right before your statement and amount due is calculated, you will effectively lower your credit utilization for that billing cycle, and increase your score. Keeping track of your statement date can take a few minutes of extra effort but this is the easiest way to increase your score, and it does not involve any changes in how your spend your money.

Please let us know in the comments if you have had success with this tip, and let us know of any other methods you have to easily increase your score.

Happy Churning

Please let us know in the comments if you have had success with this tip, and let us know of any other methods you have to easily increase your score.

Happy Churning

Comments

Post a Comment