Introduction: What is Churning?

Hi welcome to my blog! If you made it this far you likely have a lot of questions. First and foremost being, what is churning?

Churning is the act of maximizing the rewards you can get from credit card rewards from your normal everyday spending. Generally this involves signing up for new cards that have attractive sign-up bonuses, such as bonus cashback onto your statement or travel points for airlines and hotels.

Won't this hurt my credit score?

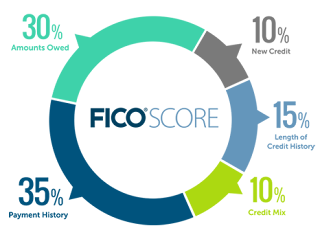

Contrary to common belief, having lots of credit cards doesn't necessarily mean you will have a bad credit score. In fact, showing that you can manage a large number of accounts and keep them in good standing will positively effect your score. The two largest factors in your FICO score is payment history, and credit utilization. These two factors account for roughly 65% of your score. To have a good or excellent payment history you have to have 97% of payments on time, so make sure you are watching your due dates on your current credit cards, and any loans that may be on your score, like mortgages, and student loans. Credit utilization is simply what % of your total credit limit are you currently using. You want this number to be a low % of your total credit limit (more on tips to keep this low and jump your credit score up in a later post). Both of these factors are not affected by churning or opening new cards

Smaller components of your score are your average age of accounts (15%), types of credit in use (10%), and new accounts or new credit (10%). Of these 3 factors, the average age of accounts and new accounts are the ones you will be impacting by churning. Your average age of accounts is going to go down as you add new cards, and if you already have a thin credit file (you haven't had credit card or loan for a long period of time) this could cause you some headache in the short term. One thing to remember is that by opening new cards and keeping them alive over the years, you will be raising your average age by quite a lot in the long term. This will be a big benefit to your score and it shows lenders that you are good at managing your money.

New accounts is where churning will look bad. Depending on how aggressive you want to be in earning rewards you will likely always have a high number of new accounts opened. Since this only accounts for about 10% of your total score, I would not worry too much about it. It is important to monitor your score, and I would suggest using one of the many tools available, like credit karma, or your credit card issuer's website (discover will show you your FICO score for free) to keep an eye on this. New accounts fall off of this category after two years, so if you feel like you are impacting your score too much, you can always hold off on getting new cards for a while to let your score increase.

NOTE: If you are someone that is looking to get a mortgage to buy a house in the next 6 months, be aware that lenders for mortgages are sensitive to how many hard inquiries are on your credit report in recently. Keep this in mind when thinking about opening new credit lines for rewards.

So now that we have covered how churning can and can't hurt your score, see what rewards you can get and how to get them in our next post.

Happy Churning!

Churning is the act of maximizing the rewards you can get from credit card rewards from your normal everyday spending. Generally this involves signing up for new cards that have attractive sign-up bonuses, such as bonus cashback onto your statement or travel points for airlines and hotels.

Won't this hurt my credit score?

Contrary to common belief, having lots of credit cards doesn't necessarily mean you will have a bad credit score. In fact, showing that you can manage a large number of accounts and keep them in good standing will positively effect your score. The two largest factors in your FICO score is payment history, and credit utilization. These two factors account for roughly 65% of your score. To have a good or excellent payment history you have to have 97% of payments on time, so make sure you are watching your due dates on your current credit cards, and any loans that may be on your score, like mortgages, and student loans. Credit utilization is simply what % of your total credit limit are you currently using. You want this number to be a low % of your total credit limit (more on tips to keep this low and jump your credit score up in a later post). Both of these factors are not affected by churning or opening new cards

Smaller components of your score are your average age of accounts (15%), types of credit in use (10%), and new accounts or new credit (10%). Of these 3 factors, the average age of accounts and new accounts are the ones you will be impacting by churning. Your average age of accounts is going to go down as you add new cards, and if you already have a thin credit file (you haven't had credit card or loan for a long period of time) this could cause you some headache in the short term. One thing to remember is that by opening new cards and keeping them alive over the years, you will be raising your average age by quite a lot in the long term. This will be a big benefit to your score and it shows lenders that you are good at managing your money.

New accounts is where churning will look bad. Depending on how aggressive you want to be in earning rewards you will likely always have a high number of new accounts opened. Since this only accounts for about 10% of your total score, I would not worry too much about it. It is important to monitor your score, and I would suggest using one of the many tools available, like credit karma, or your credit card issuer's website (discover will show you your FICO score for free) to keep an eye on this. New accounts fall off of this category after two years, so if you feel like you are impacting your score too much, you can always hold off on getting new cards for a while to let your score increase.

NOTE: If you are someone that is looking to get a mortgage to buy a house in the next 6 months, be aware that lenders for mortgages are sensitive to how many hard inquiries are on your credit report in recently. Keep this in mind when thinking about opening new credit lines for rewards.

So now that we have covered how churning can and can't hurt your score, see what rewards you can get and how to get them in our next post.

Happy Churning!

Comments

Post a Comment